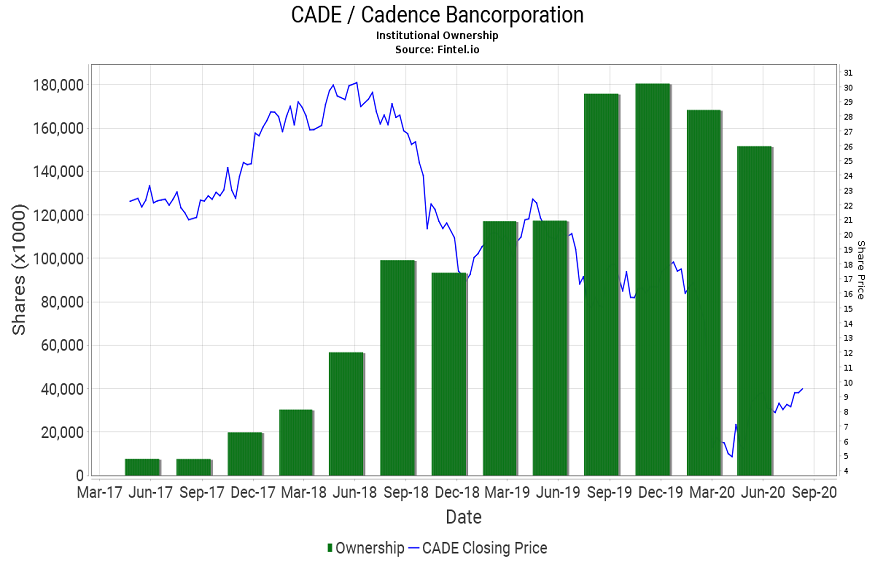

NYSE CADE Stock Details For The Investors And Shareholders

The banking sector stocks are facing huge revenue, and so most of the investors are looking for investment in such kinds of stocks. The NYSE: CADE at https://www.webull.com/quote/nyse-cade is the commercial bank stock from the company named Cadence Bancorp. The stock price of the company will let you know about the impact of this corona situation. The trade price of the company before the pandemic is 8.77 dollars. After that, the WHO has announced the pandemic situation, the bank’s trading rate has been increased more, and that is about twelve percent. Thus the current trading rate of the stock is 9.82 dollars.

Summary

The shares of the cadence Bancorp firm are sold, which is higher than the 11.72 percent of the equities in the United States. The company has reported that the growth of earning in the past twelve months. It indicates that the negative improvement that is greater than the other bank’s stock by seven percent. The revenue growth of the company is also high, and this is better than other US banks that are about approximately twelve percent. The company earnings will rise each and every year by about more than a hundred percent. The company is having a market capitalization of 1.23 billion dollars.

Purchasing tips

Many of the institutional and retail investors are looking for buying or selling the stock. Since the company is trading the ex-dividend, it is not good to invest in this NYSE: CADE stock. The shareholders and the investors will get a dividend if they have bought the share before the last week of July. Then only they will get the dividend in the first week of August. Thus comparing the last year this bank has a good trade condition in the last year. This means that investors would not have to invest in the stock that is having a high dividend. Sometimes the equation may change according to the market fluctuation. This kind of problem will be avoided when the investor is doing detailed research about the stocks before buying.

The dividend payments are the good ones but should not be less than the profit amount. This is because it will lead to a waste of the dividend amount. The company should not have fewer earnings, as this will lead to risk factors for the shareholders. It is rare to see that this kind of big company is having the loss in the last year’s report because of the fewer dividends. This is because the company has faced a thirty-seven percent decline. According to the expert’s analysis, it is better to leave the stock instead of purchasing as the earnings of the company are reducing. You can do stock trading at stock apps.

Disclaimer: The analysis information is for reference only and does not constitute an investment recommendation.